Neluns - The Modern Financial Ecosystem

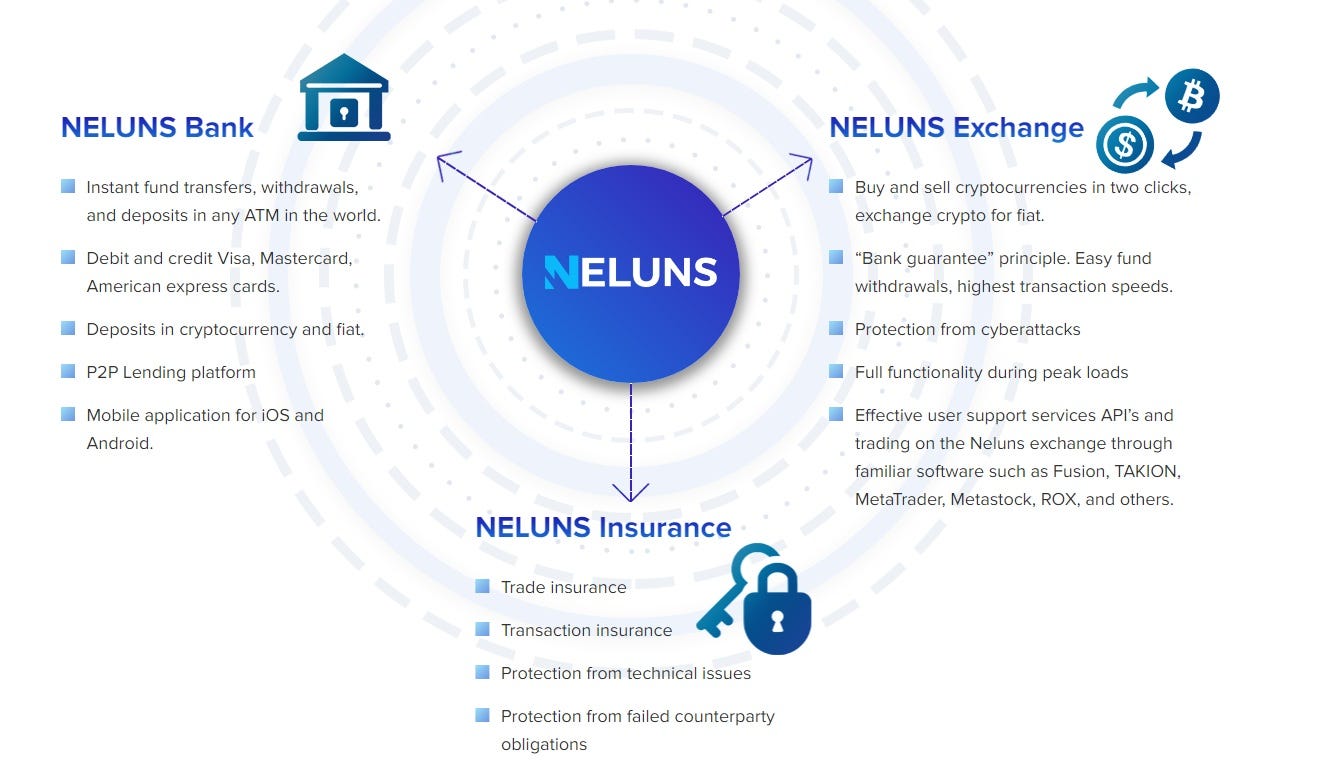

Neluns is the modern

financial ecosystem, bringing together a bank that will operate both with fiat

and crypto. Also, it will include itself a cryptocurrency exchange and

insurance company, making the best conditions for the quality evolution of the

cryptocurrency market.

To solve current problems

like limiting cryptocurrency in daily use, the possibilites of market

participants, it is need for an innovative and wide solution. Neluns goal is to

combine the cryptocurrency market with the financial one. Also, Neluns is going

to brake down all barriers and to solve some of big problems which are present

now and prevent the interaction of human with cryptocurrency world. Neluns is

coming with a solution of current problems, bringing innovative idea and

technologies.

Neluns

Bank

The first element of the

ecosystem is the Neluns Bank. Which is a licensed commercial bank, officially registered

in accordance with all regulatory requirements.

The Neluns Bank presents

a broad spectrum of services for physical and legal entities. While all

operations are available in fiat and in cryptocurrencies.

During the first stage,

Neluns Bank will carry out activities combining classical banking and banking

on the Blockchain. In the future, Neluns Bank, together with its partners, will

transition to its own Blockchain for international settlement purposes. The utilization of leading technologies

allows us to create financial products, access to which will be available

around the clock from any part of the world.

Neluns

Exchange

The Neluns Exchange

strive to become a global cryptocurrency exchange and establish itself as the

foundation for a new and complex banking architecture, which does not suffer

from the shortcomings of the existing system. We are creating an innovative

solution, eliminating the drawbacks of existing cryptocurrency exchanges.

Neluns

Insurance

A separate element of the

Neluns financial ecosystem, is the insurance company - Neluns Insurance. On

demand of the bank and cryptocurrency exchange users, it will carry out

insurance coverage for financial risks, tied to trades and transactions.

Ecosystem users will have access to full and

partial risk insurance.

• Full insurance.

Provides insurance coverage in full when an insured event occurs.

• Partial insurance.

Limits insurance coverage as certain insurance amounts, as well as the system

of specific insured event occurrence conditions.

The base insurance premium amount with full

coverage comprises 10% from the total trade/transaction sum. It can change

depending on a row of criteria. The cost of partial coverage is determined

individually for each specific case.

After the insurance

payment is paid, the claim right of the defaulting party is transferred from

the insured to the insurer.

Clients will have access to the following

insurance services:

• Risk insurance for defaulting counterparties

when executing transactions. •

Insurance in case of unforeseen circumstances during transactions.

As the ecosystem develops, the set of

insurance products will be expanded. The following services will be added to

the basic services:

• Insurance of credit and

deposit risks.

• Insurance of investment

risks.

• Insurance of financial

guarantees.

ROADMAP

Issuance

of bank cards

After receiving a bank

license and connecting to SWIFT, we will connect Neluns Bank to a variety of

payment systems (Visa, MasterCard, American Express, and others).

As an issuing bank,

Neluns will perform the following functions:

• Issuance of bank cards

to clients.

• Authorization of

payments at the request of retail outlets.

• Payment of merchant

accounts by writing off corresponding amounts from the client accounts.

• Issuing cash money in

any partnering ATM’s of Visa, MasterCard, American Express, worldwide.

• Security (blocking of

accounts in the case of lost cards, etc.)

Holders of cards issued

by Neluns Bank, will be able to pay for purchases. At the same time, payments

in both fiat and cryptocurrencies are allowed. In case of payments being made

in cryptocurrencies, they will be converted into fiat based on current Neluns

Exchange market rates.

To make it easy, card

issued by Neluns Bank use Contactless payment systems (MasterCard Contactless,

Visa paywave, Apple Pay, Samsung Pay, Google Pay), modern, innovative

technologies consistent with EMV (Europay+Mastercard+Visa) in accordance with

the ISO/IEC 14443 standard.

Aside from this, Neluns

Bank users will be able to deposit fiat in any ATM, anywhere in the world, onto

their bank accounts.

In the future, we plan to

develop our own POS-terminals. They will be installed in sales outlets of bank

clients. Thus, Neluns will combine the functions of an issuer and acquirer in

the future.

We have developed

software products with 4 types of bank cards:

Lite

–

bank card released for first level verified users (email address). Users can

participate in trades on the Neluns Exchange (with 1:5 margin trading). Trade

sums cannot exceed $300.

Silver

– bank card released for second level verified users (verification through

social networks and mobile number). Users can participate in trades on the

Neluns Exchange (with 1:10 margin trading) and the P2P lending platform. Trade

sums cannot exceed $500.

Gold

– bank card released for third level verified users (verification through

identity verification and mobile number).

Users gain access to all Neluns Bank services, Neluns Exchange (with

1:20 margin trading), Neluns Insurance. Restrictions on trade amounts are

absent.

Platinum

– bank card released for third level verified users (verification through

identity verification and mobile number), who have deposited no less than $5000

in the Neluns Bank. Users gain access to all Neluns Bank services, Neluns

Exchange (with 1:20 margin trading), Neluns Insurance. Restrictions on trade

amounts are absent.

NLS

Token

The NLS token is created

in accordance with the ERC-20 standard.

The NLS token is a

security token.

The NLS token will

provide holders with dividends in the amount of 50% of the profits of the

Neluns ecosystem (Neluns Bank, Neluns Exchange, Neluns Insurance). Dividends

will be distributed each quarter in proportion to the number of tokens held

comparative to the total number of tokens in circulation.

Aside from this, NLS

token holders will have an access to bonuses and privileges when using products

of the Neluns ecosystem. The more NLS tokens a holder has, the more privileges

he will receive.

NLS tokens can be

acquired throughout the Pre-Sale, Pre-ICO, and ICO. The acquisition of NLS tokens

in the secondary market will be possible immediately after listing on

cryptocurrency exchanges.

Unsold tokens will be

frozen after the ICO. Each year, 3% of the tokens will be burned.

NLS

token emission

During the ICO, 200 000

000 NLS tokens will be released

Base price of 1 NLS token

= 1 USD

NLS

token distributions

80% tokens will be sold

during the ICO

12% tokens will remain

with the platform development team

5% tokens will be

directed towards the Bounty campaign

3% tokens will be

retained by project advisors

Expected

price of NLS

The economic modeling of

business process allows us to forecast the NLS token price growth over a short,

medium, and long-term perspective.

Neluns

ICO

Stages

(rounds) ICO

Pre-Sale

Hard Cap - $2.000.000

Soft Cap - $500.000

1 stage (round),

pre-sale, stage (round) length 14 days,

from 08-01-2018 to

08-15-2018.

Pre-ICO

Hard Cap - $10.000.000

Soft Cap - $2.000.000

2 stage (round), pre-ICO,

stage (round) length 21 days,

from 08-15-2018 to

09-05-2018.

ICO

Hard Cap - $112.000.000

Soft Cap - $10.000.000

3 stage (round), ICO,

stage (round) length 31 days,

from 09-05-2018 to

10-05-2018.

PROFIL BITCOINTALK : https://bitcointalk.org/index.php?action=profile;u=2275669;sa=summary

Komentar

Posting Komentar